-96%

Royal Hedge Fund Ea Source code mq4 V2.0 with Setfiles

Original price was: $1,399.00.$49.99Current price is: $49.99.

Royal Hedge Fund EA Source Code MQ4: advanced hedging scalper achieves 223% verified gains with 6.03% drawdown. Complete MT4 source code for prop trading success.

✓

Verified Original & Safe

✓

Instant Download After Purchase

✓

Free Updates for Future Versions

✓

Free Dedicated Remote Support

✓

Unlimited Activations on Your Accounts

✓

Money-Back Guarantee (Details)

Secure Checkout

Table of Contents

What is Royal Hedge Fund EA?

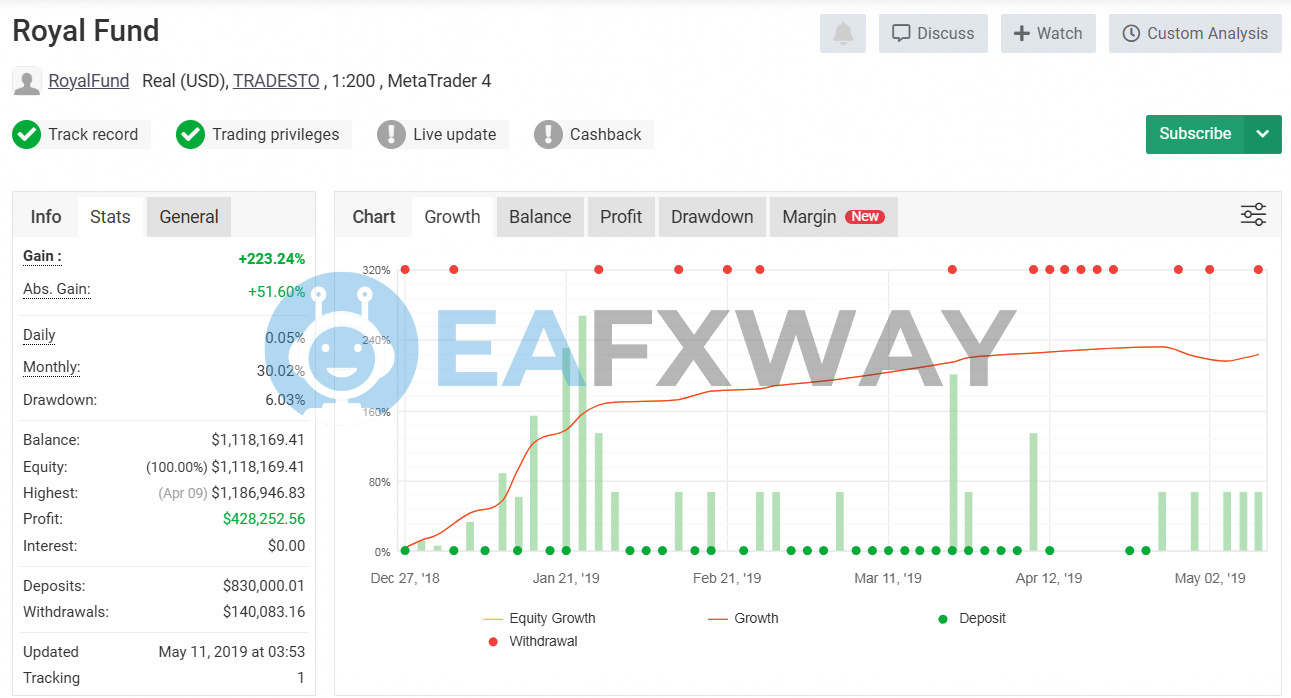

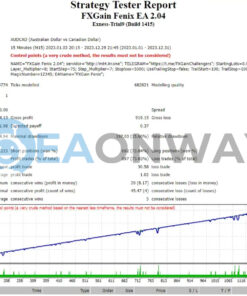

Royal Hedge Fund EA is a cutting-edge automated trading solution for MetaTrader 4 that combines high-frequency scalping with advanced hedging techniques to achieve consistent profitability across multiple markets. The EA delivered outstanding verified results with +223.24% gain over 6 months, maintaining an impressive 30.02% monthly profit rate while keeping maximum drawdown at just 6.03%. This sophisticated system targets both retail traders and proprietary firm challenges by employing institutional-grade strategies without relying on dangerous Martingale or Grid methods.

- Vender website: https://www.royalbotclub.com/

Key Takeaway

• Overview: Advanced automated trading system featuring configurable session trading, intelligent hedging across currency pairs, risk-based position sizing, and comprehensive trade management tools for MT4 platform

• Trading Strategy: Implements high-frequency scalping methodology using price action analysis at key support/resistance levels combined with strategic hedging; executes multiple simultaneous positions across different currency pairs to minimize directional market risk

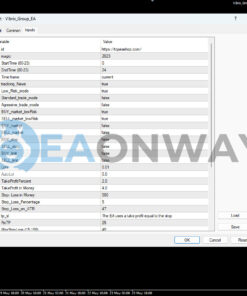

• Algorithm Components: Utilizes technical indicator confirmation signals with price action validation for entry timing; incorporates automatic volume adjustment based on risk percentage, configurable order distances, trailing stop management, and session-specific trading hours (10:00-22:00 or 16:00-22:00)

• Key Advantages: Demonstrates exceptional risk-adjusted returns with historically low drawdown performance and consistent monthly profitability, but requires premium broker execution quality and careful parameter optimization; complete source code access enables full strategy understanding, though optimal results depend on broker-specific fine-tuning.

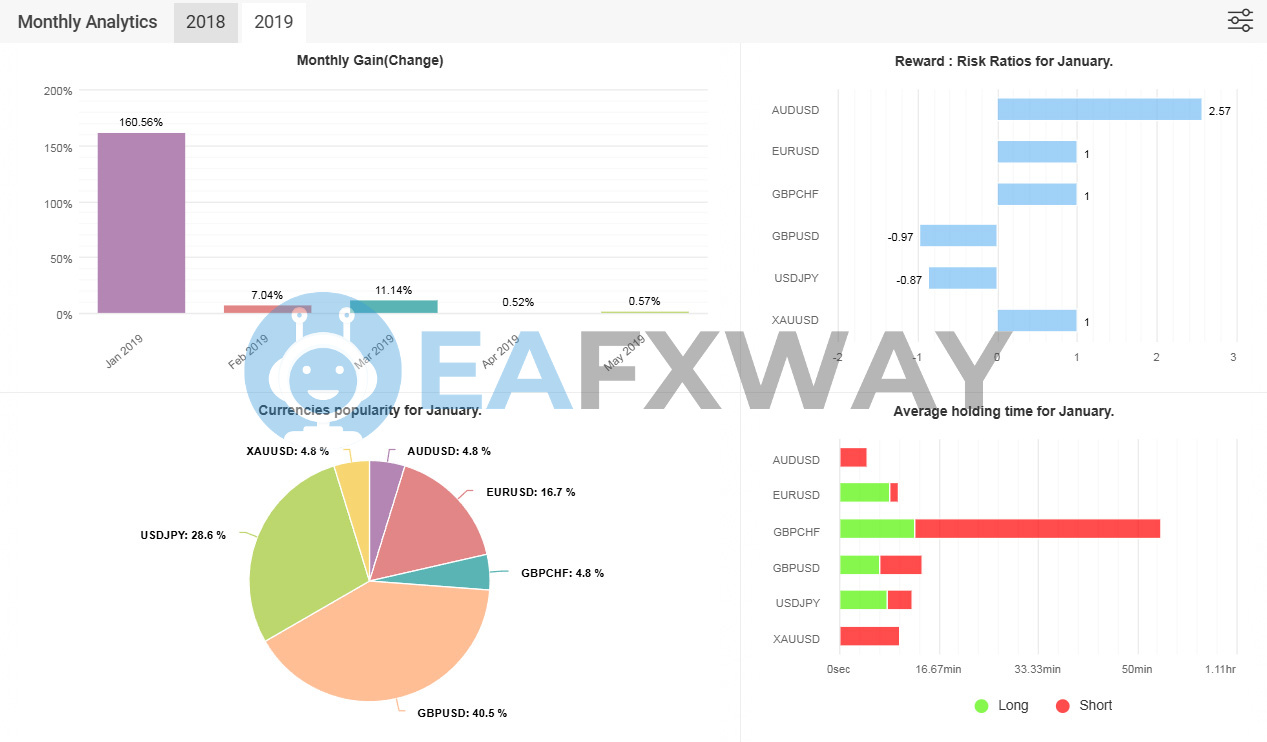

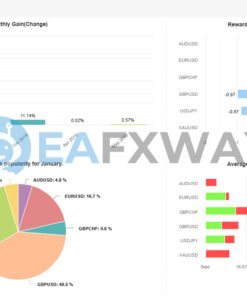

• Performance Metrics: Myfxbook-verified +223.24% total gain with 0.30% average daily growth and 30.02% monthly profit over 6-month tracking period, though 2019 historical data may not reflect current market volatility; individual pair performance ranges from +2.57 reward-risk ratio (AUDUSD) to -0.97 (GBPUSD)

• Strategic Risks: Success heavily dependent on broker execution speed and spread conditions inherent to scalping strategies; limited to configured trading hours potentially missing market opportunities; hedging complexity requires adequate margin management and understanding of pair correlation dynamics

Recommendations for Royal Hedge Fund EA

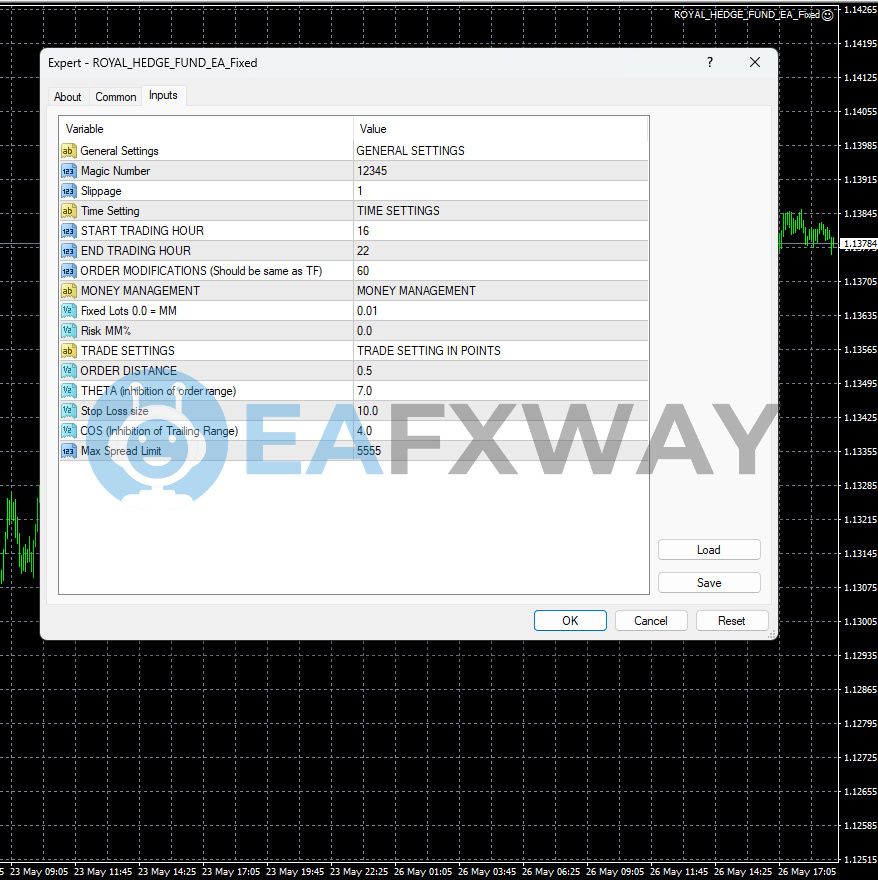

• Trading Platform: MetaTrader 4 (MT4) exclusive compatibility

• Supported Pairs: EURUSD, GBPUSD, USDJPY, XAUUSD, AUDUSD, GBPCHF, US30, NAS100 – note GBPUSD historical underperformance with -0.97 reward-risk ratio

• Account Specifications: ECN or ultra-low spread accounts essential – high-spread standard accounts will severely impact scalping profitability due to frequent trade execution

• Optimal Timeframe: M5 (5-minute) charts exclusively – strategy specifically calibrated for short-term price movement patterns

• Trading Hours: NY session focus (16:00-22:00) or extended session (10:00-22:00) configurable – trading activity minimal outside these designated periods

• Leverage Requirements: 1:200 leverage as demonstrated in verified results – higher leverage magnifies both profit potential and loss exposure; ensure sufficient margin capacity for multiple hedged positions

• Capital Requirements: $100 stated minimum deposit, but $1000+ strongly advised for proper risk distribution across multiple simultaneous positions and adequate hedging margin coverage

Royal Hedge Fund EA Review

Royal Hedge Fund EA excels in risk management with verified low-drawdown performance, making it ideal for traders seeking consistent growth with capital preservation focus.

Performance Summary:

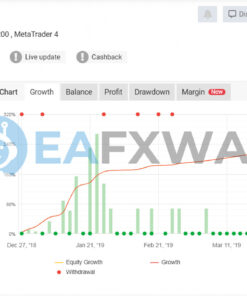

• Total Return: +223.24% gain over 6-month period with exceptional risk control

• Monthly Consistency: 30.02% average monthly profit with only 6.03% maximum drawdown

• Daily Efficiency: 0.30% average daily growth rate with minimal volatility

Monthly Breakdown Analysis:

• Peak Month: January 2019 delivered 160.56% gain (likely account scaling effect)

• Stable Months: February through May showed 0.52% to 11.14% consistent growth

• Trading Distribution: GBPUSD dominated at 40.5% activity, USDJPY at 28.6%

• Trade Duration: Efficient 17-50 minute average holding periods across pairs

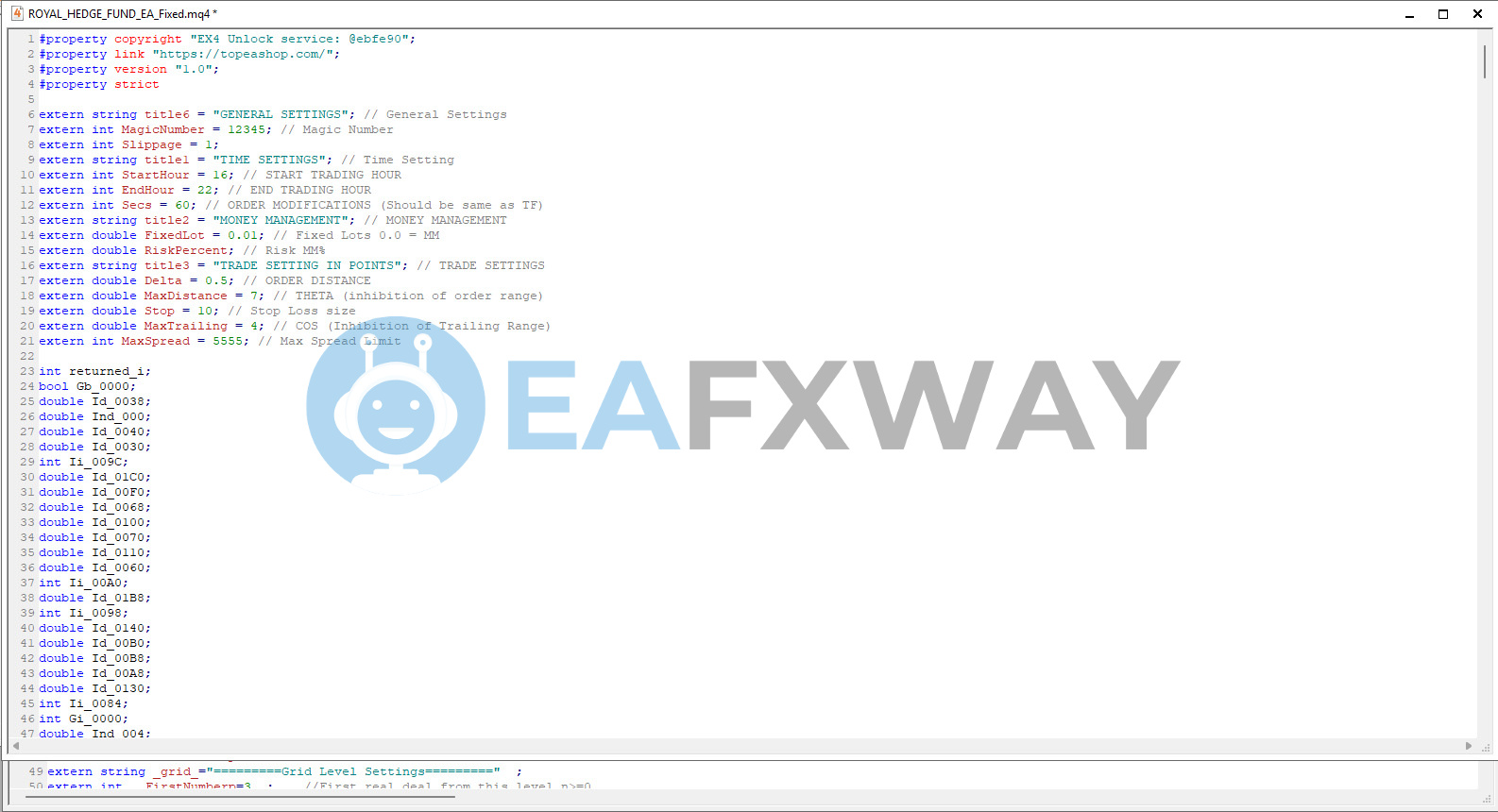

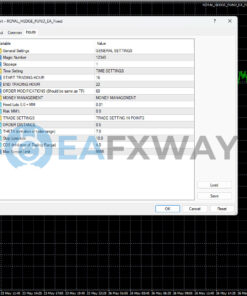

System Configuration:

• Risk Controls: Percentage-based lot sizing with automatic volume adjustment

• Trade Management: Configurable stop losses, trailing stops, and order distance settings

• Time Management: Session-based trading with spread and slippage protection limits

Why Choose Royal Hedge Fund EA

• Superior Risk-Reward Profile: Myfxbook-verified 6.03% maximum drawdown alongside 30.02% monthly returns demonstrates institutional-quality risk management, though 2019 performance data requires current market validation and broker-specific testing

• Professional Trading Methodology: Employs sophisticated HFT scalping and hedging strategies typically reserved for proprietary trading firms and hedge funds, but success critically depends on broker execution quality and optimal spread conditions

• Full Strategy Transparency: Complete MQ4 source code access allows thorough strategy analysis and customization capabilities, though effective modifications require advanced MQL4 programming expertise and market understanding

• Funded Account Compatible: Specifically engineered to meet proprietary firm challenge requirements with conservative risk approach, but individual firm rules and risk parameters may require strategy adjustments

• Multi-Asset Diversification: Intelligent trading across forex majors, precious metals, and stock indices with correlation-based hedging, though individual asset performance varies significantly requiring careful pair selection and monitoring

Conclusion

Royal Hedge Fund EA presents compelling risk-adjusted performance for sophisticated traders with access to premium execution environments, particularly suitable for prop firm aspirants and experienced scalpers. Success requires careful broker selection, parameter optimization, and realistic expectations based on current market conditions rather than historical 2019 data alone.

Royal Hedge Fund Ea Source code mq4 Download Packages:

- Link download experts:

- Royal Hedge Fund Ea Source code .mq4 (source code)

- Presets:

- ROYAL HEDGE FCFF – $100K.set

- ROYAL HEDGE ICEMARKETS – $100K.set

FAQs

What are the Royal Hedge Fund EA's typical monthly profit and maximum drawdown?

Is there verified proof of its performance?

What trading strategy does the Royal Hedge Fund EA use?

Does it use risky strategies like Martingale or Grid?

Which trading platform is this EA compatible with?

What capital is needed to use this EA effectively?

What type of broker account is best for its scalping strategy?

Are there recommended settings or a setup guide for this EA?

Who is this automated trading solution best for?

Does this EA include its source code?

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.